E&D Waiver Overview

The E&D Waiver is Alabama’s largest medicaid waiver, with 15,000 slots available as of January 1, 2024. It is NOT at capacity and does not have a waiting list. This waiver helps people who need the same level of care that would usually be provided in a nursing facility but want to receive services at home or in the community instead.

The E&D Waiver is administered by the Alabama Department of Senior Services (ADSS).

Key Features

- No age requirement – This waiver is not just for seniors. Anyone who qualifies based on their care needs can apply.

- Must require Nursing Facility Level of Care (NF LOC) MM.– In other words, you must need care that’s typically given in a nursing home.

- No cost cap – There’s no yearly limit on the amount or cost of services you can receive through the E&D Waiver.

This waiver is designed to help individuals stay in their homes, maintain independence, and avoid unnecessary institutionalization.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

Eligibility for the E&D Waiver

Financial Eligibility

All 7 waivers have the same financial eligibility rules.

Medicaid waiver programs, including the E&D Waiver, have more flexible financial rules than standard Medicaid. Here’s what you, the person with a disability, need to know:

- If one receives SSI benefits, one automatically qualifies financially for a Medicaid waiver.

- One can also qualify if one’s income is up to 300% of the Federal Benefit Rate (FBR). In the calendar year 2025, the FBR is $967 per month, meaning one can have an income of up to $2,901 per month and still be financially eligible for a Medicaid waiver.

While income limits are more generous, there is a resource limit. This means one generally can’t have more than $2,000 in resources (like money in bank accounts) in your name on the first day of each month, or you could lose your Medicaid eligibility.

If you have questions about managing your money and resources to maintain your waiver eligibility, it’s a good idea to talk to an attorney, as everyone’s situation is different.

Important Note for Children: When a child under 18 applies for a Medicaid waiver, only the child’s income and resources are counted, not the parents’. Usually, a child will have no income, making them financially eligible. If a child receives SSI, they are also automatically financially eligible.

Example: A young man earning $1,000 per month at a part-time job wouldn’t qualify for standard Alabama Medicaid (which has an income limit of $963 per month in 2024). However, because his income is below the $2,829 per month limit for a waiver, he could be financially eligible for an ACT Waiver. If he qualifies for the waiver, he can also receive all basic Medicaid services.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

Medical & Program Eligibility for the E&D Waiver

To qualify for the Elderly & Disabled (E&D) Waiver, one must be at risk of being placed in a nursing facility.

What does that mean?

One must need the kind of full-time, hands-on care and supervision that is typically provided in a nursing facility. This usually applies to individuals who:

- Can’t care for themselves safely for an extended period of time

- Need regular help with things like bathing, dressing, eating, mobility, or taking medications

✅ If one meets these medical needs, you’re considered medically eligible for the E&D Waiver.

Nursing Facility Level of Care (NF LOC)

Alabama has specific guidelines to decide if someone meets the NF Level of Care.

A checklist to help you understand these requirements is available at this link. MM.

Program Eligibility

Unlike other waivers in Alabama:

❌ There are no extra program eligibility requirements for the E&D Waiver.

If you meet the medical criteria, you may qualify.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

How can physicians assist families in the application process?

Physicians MUST provide documentation that supports whether or not their patient is eligible based on the waiver eligibility criteria of nursing facility level of care (NF LOC) MM. Physicians’ notes will be reviewed, and physicians are asked to certify that their patients meet 2 criteria for the waiver. Without physician documentation confirming this, patients will be unable to access this waiver. Physician documentation and advocacy on behalf of their patients is essential!

E&D Waiver Application Guide

Who Handles Applications?

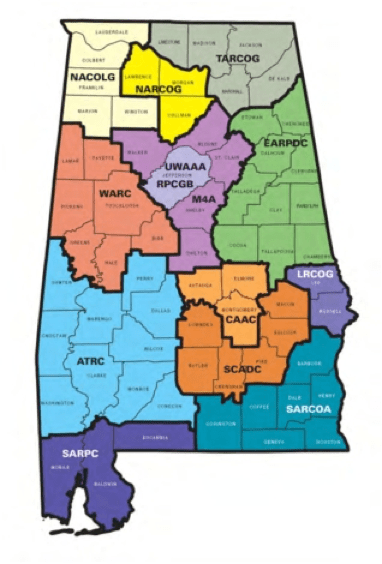

The Alabama Department of Senior Services (ADSS) has local partners called Area Agencies on Aging (AAAs) that take and process E&D Waiver applications.

A full list of AAAs and their contact information is on our waiver contact page.

⚠️ Application steps may vary depending on one’s local AAA.

Some may just ask for a phone call. Others may send one a form to fill out. Ask for everything to be done in writing and for dated copies of each form. Note: one does NOT have to have a referral from a physician to start the application process!

Before You Apply: Gather This Information

To make the application process smoother, collect the following items:

- Medicaid card (if already enrolled), Social Security Number, and birth certificate

- Immigration documents (if the applicant is not a U.S. citizen)

- Medical documentation showing the applicant’s disabilities and why they need nursing-level care (e.g., doctor’s notes or diagnosis letters)

NOTE: It is advised to have one’s hospital and physician’s/primary care clinic send over the entire chart by sending a record’s release to their medical records department. This may require multiple records releases and record requests. It is imperative to get ALL records sent for review, not just those from one physician. It may also be helpful for the patient to visit their primary physician in advance of the application process. During this appointment, ask the physician to confirm that they have noted the patient’s eligibility criteria with details of their needs.

Starting the Application

- Contact your local AAA.

- Find your county’s AAA and call them.

- You may need to leave a message or schedule an appointment.

- If you do not hear back in a few days, follow up!

- Be clear when describing the applicant’s needs.

- Focus on why the person needs nursing facility level of care (NF LOC).

- Avoid downplaying their support needs.

- Some staff may try to discourage you—stay firm and ask questions.

❗ If you’re told the applicant does not qualify, ask:

- “Are you officially denying this application?”

- “Can I have the denial in writing?”

This often encourages them to continue the process.

Is there a waiting list for the E&D Waiver, and how long should the application process take?

There is no waiting list for this waiver program. This waiver includes 15,000 slots statewide. Once the application is complete and submitted by the family working with the AAA, the state has 90 days, per federal law, to determine eligibility. Families, NOTE THE DATE OF THE APPLICATION, take a picture of the application before the worker leaves your home, and keep in contact with the AAA to hold them to this deadline.

NOTE: Some AAAs are taking a LONG time to come to the applicant’s home in order to complete the waiver application. This delay is causing a delay in the clock starting on the 90 eligibility determination. Advocate for a quick turn around! Take the earliest appointment available! Date the application, take a photo of it, and note on your calendar when the 90 day deadline ends! It is also helpful to complete medical record release forms at the primary doctor’s office and with the treating hospital in advance to avoid further delays.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

What Happens After You Apply for the E&D Waiver

- Some AAAs may request medical records from the applicant’s doctor(s), but doctors and hospitals cannot release these records without a signed release. Releases must be complete with both the doctor’s office and the hospital.

- They usually review the last 12 months of progress notes.

NOTE: They will likely request 12 months of notes, will need notes from all physicians and hospitals, but may only send a request to one physician. Ask that they request records from ALL physicians and hospitals and provide record releases for each.

- Track how long it takes—follow up regularly to keep things moving.

No Immediate Decision—Here’s Why

A unique feature of the E&D Waiver is that eligibility is determined after you’re placed on the referral list, not right away.

So when you first apply:

- You will not receive an immediate “yes” or “no” on eligibility.

- The referral list works like a waiting list, but with a key difference:

Eligibility is only checked when your name comes up and services are available.

Timeline: You Should Hear Back Within 90 Days

Federal law gives Medicaid applicants 90 days to receive an eligibility decision for disability-based services (like the E&D Waiver). NOTE: Any delay in the application process, including the AAA’s delay in coming to the home of the individual to complete the application, will delay the start of the 90 days.

That means:

- One should hear back within 3 months of applying.

- If one is approved, you’ll move forward in the process.

- If one is denied, one must be notified in writing and told about appeal rights.

Stay in touch with your AAA during this time, and don’t hesitate to follow up if you’re not hearing updates.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

Applying for Multiple Waivers

Good news! You can:

- ✅ Apply for more than one waiver at a time

- ✅ Stay on multiple waitlists simultaneously

- ✅ Receive services from one waiver while staying on the waitlist for another

🚫 However, you cannot receive services from more than one waiver at the same time.

Approved: Next Steps

ACTION MUST BE TAKEN!

As soon as approved for the waiver, it is important to watch your mail CLOSELY for any items from Alabama Medicaid. Follow the instructions carefully!!! If you do not receive mail from Alabama Medicaid, contact the Alabama Medicaid office (see below).

When your Alabama Medicaid card comes in the mail, take it to all of your physicians and providers, including your primary doctor/pediatrician, and get a yearly Medicaid screening, called EPSDT. Do this right away, and be sure to tell your primary doctor all of the supplies and prescriptions ordered by other doctors as well as all that are needed or may be needed within the next year. The primary doctor has to document everything in this annual screening. Remember, this EPSDT screening must be scheduled every year with your primary doctor, and that doctor must be a Medicaid provider.

If you do not quickly receive a Medicaid card or letter from Alabama Medicaid, call your AAA, your local Medicaid office, and the state Medicaid office immediately. See our contact page at this link for phone numbers. TT. Tell them that the individual is “deeming” (use that word!) and approved for the Elderly and Disabled Waiver. Ask how long it will take to get Medicaid approval and the card in the mail.

Getting Alabama Medicaid approval is a separate step from being found eligible for a Medicaid Waiver.

EVERY YEAR:

- A check up, called an EPSDT screening, must be completed at the primary doctor/pediatrician’s office. This is the patient/caregiver’s responsibility to schedule. Tell the scheduler at the doctor’s office that you are scheduling the “annual EPSDT screening appointment”.

- The individual must be found, based on this screening and other records from this doctor, that they still meet eligibility for the waiver each year. Be sure the doctor is documenting Nursing Facility Level of Care eligibility. If it is not documented by the doctor, the individual could be found ineligible, meaning they could lose the waiver and possibly Medicaid coverage.

- When you receive any mail from Alabama Medicaid, read it carefully and follow the instructions! They will send an annual letter to determine ongoing eligibility. If action is not taken quickly, one could lose Medicaid and waiver eligibility.

Additionally, the AAA will begin the following process:

- Face-to-face Independent Functional Assessment

- Develop a Person-Centered Plan (PCP)

Once approved, what happens?

An Independent assessment of functional need should take place with the involvement of the individual and caregiver. The assessment must be face-to-face in person or virtually. It is helpful for the family to provide written documentation about their loved one’s interests and goals. They should also consider providing a detailed daily schedule which includes all skilled care, unskilled care, housekeeping, errands, education, assistance in the community, therapies, use of medical devices/assistive technology, etc. that the individual requires on a daily basis. This allows the person assessing the need to better understand the amount of time and type of skills required.

Person-Centered Plan (PCP) NN.

“The person-centered service plan must reflect the services and supports that are important for the individual to meet the needs identified through an assessment of functional need, as well as what is important to the individual with regard to preferences for the delivery of such services and supports.”

Person-centered planning:

● Includes the people chosen by the individual

● Allows the individual to direct the process

● Is timely and convenient to the individual

● Reflects cultural needs and is accessible to the individual

● Includes conflict of interest guidelines

● Includes a method for updating the plan

● Records alternative settings for the individual

A person-centered plan must include:

● The setting the individual chooses to reside in.

● The individual’s strengths and weaknesses.

● Clinical and support needs identified by the assessment

● The individual’s goals and desired outcomes.

● The services and supports, both paid and unpaid, required to achieve the individual’s goals.

● Providers of those supports and services, including natural supports who are unpaid and provide their service voluntarily.

● Backup plans and strategies to reduce risks.

● Language that is understandable to the disabled and supportive individuals. ● Those services the individual chooses to self-direct.

● Supports and services provided through other sources such as school and vocational rehabilitation.

Person Centered Plans must be reviewed and revised upon independent assessment at least every 12 months, when the individual’s circumstances change significantly, and at the request of the individual.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

E&D Waiver Services

Services that can be self-directed through the Personal Choices program are in bold.

· Case Management

· Adult Day Health (with or without transportation)

· Skilled Respite

· Home Delivered Meals

· Pest Control

· Skilled Nursing

· Home Modifications

· Assistive Technology and Durable Medical Equipment

· Personal Emergency Response Systems (PERS) (Installation and Monthly Monitoring)

· Medical Supplies

· Supervisory Visits

· Homemaker Services

· Personal Care

· Unskilled Respite

· Adult Companion Services

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

How can medical providers assist in accessing medical supplies, assistive technology, etc.? How much is covered per year by the E&D Waiver?

Doctors should be able to prescribe necessary supplies, such as 7 diapers or pull ups per day and 2 boxes of gloves per month) and services through a local provider. For children covered through EPSDT, coverage will have to be run through AL Medicaid first. If a written denial is received, then the individual or representative of the individual should request E&D Waiver coverage for the supplies and services. In addition, these needs should be specifically addressed in the Person Centered Plan. Adults on the E&D Waiver who do not have EPSDT coverage should discuss needs and put those needs in writing to the case manager from the AAA.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

Personal Choices Program – self-directed services

What is Personal Choices, and how are those services different from other waiver services? Can I have both? How much are workers through Personal Choices paid per hour?

The Personal Choices program allows those on the E&D Waiver to self-direct some of the services. This allows the disabled or elderly individual to either be their own employer or choose a close family member or friend to be the employer for their self directed services. With Personal Choices, workers are hired by the employer rather than hiring through a home health company. Employees can be chosen from the individual’s family members, friends, neighbors, or whomever they prefer as long as the employee is 18+ and passes the background check. The employer cannot also work as an employee.

Which services can be self-directed through the Personal Choices Program?

Unskilled Respite

Homemaker

Personal Care

Adult Companion Services

Can you receive services through the Personal Choices Program AND traditional waiver services?

YES!

What is the per hour rate allocated through the Personal Choices program?

Homemaker ($17.36/$14.76)

Personal Care ($17.68/$15.03)

Unskilled Respite ($17.68/$15.03)

Adult Companion Service ($15.76/$13.40)

(*Fee schedule as of October 1, 2022. Parentheses show the wage per hour before the FMSA’s 15% is deducted/after 15% is deducted for the mandatory FMSA fee.)

Can parents be employees for their child’s services?

YES! As long as the individual on the program is the employer or a separate employer can be identified, parents can work as the employees.

Is the income earned under the Personal Choices program taxable?

Income through Personal Choices may be excluded from taxable gross income because they are considered difficulty of care payments. This applies to those living full time in the same home as the individual no matter if they are related or not. For examples of specific scenarios, go to the following link:

Certain Medicaid Waiver Payments May Be Excludable From Income

Additional Information on Taxes and Waiver Service Employees

What kind of budget does the E&D Waiver provide for the services above?

The budget depends on the assessment of the person’s needs. But, we can give you a breakdown of how much per hour can be paid to service providers and how much per year or lifetime is approved by CMS for the waiver to cover for each individual on the program.

Homemaker ($17.36/$14.76)

Personal Care ($17.68/$15.03)

Unskilled Respite ($17.68/$15.03)

Adult Companion Service ($15.76/$13.40)

Medical Supplies ($1200/yr)

NOTE: There is a form for extra supplies that the medicaid waiver counselor can fill out. The physician will need to sign the form. Then, the form is sent to a Medicaid Waiver contracted durable medical equipment (DME) provider.

Assistive Technology and DME ($2000/lifetime)

Home Modification ($5000/lifetime)

In parentheses are the budgeted wages per hour before the financial management company takes their 15% mandatory fee and what remains for the worker to be paid per hour. See more about the self-directed services allowable on this waiver below.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

What is the FMSA?

- Financial Management Services Agency

- Manages payroll and timesheets

- Charges a mandatory 15% fee

Budgeting/Spending Plans

- Budget created by AAA based on PCP

- Individual chooses how to spend funds (within 75% staffing rule)

Why does the FMSA take 15% of our budget?

The Financial Management Services Agency (FMSA) is used for the Personal Choices program. Timesheets are submitted to the FMSA, and pay is distributed to the employees by the FMSA. There is a mandatory 15% fee for the use of their service.

What is a “budget”? What is a “spending plan”?

Note: The following only applies to those supports and services being provided through the Personal Choices Program. Traditional waiver services do not require this step.

BUDGET EXAMPLE

Section 1, Step 1 below shows how the budget is calculated by ADSS and your local AAA. Based on the assessment and determination of need as well as the Person-Centered Plan, ADSS and your local AAA create a budget.

By multiplying the hours per week for each self-directed service times 4.43, the number of hours per month is calculated. That total is then multiplied times the rate per hour for that service. Each “Total Hours Per Month x Rate” are added together to come to the “Total Amount Authorized”

The following is an EXAMPLE of how a budget is calculated:

Section 1: Basis for Individual Budget

Step 1: Converting your Waiver Services

| Service | Hours Per Week | Monthly Multiplier | Total Hours Per Month | Waiver Rate Per Hour |

| Companion – Personal Choices | 20.00 | 4.43 | 88.60 | $15.76 |

| Homemaker – Personal Choices | 7.00 | 4.43 | 31.01 | $17.36 |

| Personal Care – Personal Choices | 60.00 | 4.43 | 265.80 | $17.68 |

| Total Amount Authorized |

Step 2: Your Counseling and Financial Management Services Cost

Total Amount Authorized from Step 1

Counseling/FMSA Fee

Total Amount Authorized x Fee% = Total Counseling & FMSA Fee

Step 3: Total Individual Budget Dollars

Total Amount Authorized from Step 1

Participant Budget: $5638.01

EXAMPLE Explanation:

Step 2 requires deducting a mandatory 15% to cover financial management costs for the FMSA. The “total budget dollars available to you” is shown at the bottom of page one after the FMSA fee is subtracted. That total is then transferred to the top of page two as your “Participant Budget Amount” provided to you monthly.

Section 2 should arrive at your meeting blank except for the “Participant Budget Amount” in the top right corner. ADSS and the local AAA are not to dictate to the individual how their budget is spent.

There is one important rule to keep in mind: you must use 75% of the total “hours per week” used in the calculations in Section 1, Step 1 to come to the final total “authorized hours per week” in Section 2, Step 1. In Section 2, Step 1, the individual can choose to pay any rate above minimum wage to their employees, including a rate higher than the “waiver rate for pay”.

In the example provided, we see the following:

● Section 1, Step 1 “Hours per week” total = 87

● To calculate the minimum number of hours needed in Section 2, Step 1: 87x.75=65.25

● The total “Authorized Hours Per Week” in Section 2, Step 1 must be equal to or greater

than 65.25

● In our example, the individual decided to raise the hourly wage and reduce the hours.

● Also note that all hours are in the row for one employee. This was done so the individual would have flexibility from week to week to schedule employees as they are available.

● Also, notice that in the example below 2 employees are “exempt” from taxes. This is due to them living full time in the same household as the individual. Their hourly wage equals the hourly wage of those not living in the home plus taxes. 17.38+1.90=19.28

EXAMPLE Continued:

Participant Budget Amount: $5638.01

Section 2: Calculate Employee Services Cost

Step 1: Calculate Employee Services Cost

| Employee Name | Employee Relationship | Authorized Hours per week | Hours per month | Hourly wage | Employer Taxes per hour | Hourly wage+ Employer taxes=Total Hourly | Hours per month x total hourly cost= Total month |

| Doe 1 | Parent (lives in same home) | 66 | 292.38 | $19.28 | $0 | $19.28 | $5637.09 |

| Doe 2 | Grandpa (lives in different home) | $17.38 | $1.90 | $19.28 | |||

| Doe 3 | Roommate (lives in same home) | $19.28 | $0 | $19.28 | |||

| Doe 4 | Friend (lives in different home) | $17.38 | $1.90 | $19.28 | |||

| Doe 5 | Employee | $17.38 | $1.90 | $19.28 |

Total Hours Per Week 66.00 Total Monthly Cost $5637.09

Do all workers share hours? Yes

Waiver Hours (Section 1) 87.00

Maximum Hours Per Month 385.41

Section 3: Goods & Purchases, Cash Needs, Savings

Step 3: Calculate Costs of Goods, Purchases, Cash Needs and Savings

● At this time, ADSS has not always provided easy access for recipients to get the money in this category, so we do not recommend putting money into Section 3.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

Elderly and Disabled (E&D) Waiver Additional Benefits

- AL HIPP Program: Helps cover private insurance premiums

- Medical Case Management: Through Alabama Select Network (ASN)

- Transportation: Medicaid Non-Emergency Transportation — 1-800-362-1504, Option 4

What is AL HIPP?

Once on Alabama Medicaid, those who also have private health insurance should contact the AL HIPP office at 1-855-MyALHIPP (1-855-692-5447). Those who qualify for the E&D waiver also often qualify for Alabama HIPP to cover the private group health insurance premiums or COBRA for the entire family.

How do we access medical case management?

While case management of waiver services is provided by the local AAA, medical case management is a separate service provided by Alabama Select Network (ASN). Medical case management through ASN provides disease education, medication review and case management support to help you manage your chronic condition, medical, and long-term service and support needs. Tell your AAA case manager you would like a referral for medical case management, and call ASN at 855-288-7755.

ASN Case Managers will also:

● Work with you to ensure that you have all the information you need to make good choices about your health care.

● Help you get the right kind of long-term services and supports in the right setting for you to address your needs.

● Coordinate all of your physical health, mental health, and long-term services and support needs.

● Help to solve issues that you have about your care.

● Make sure that your Care Plan is followed and is working the way that it needs to.

● Be aware of your needs as they change, update your Care Plan (at least every 6 months, and as needed), and make sure that the services you get are appropriate for your changing needs.

● Check at least once a year to make sure that you continue to need the level of care provided in a nursing home.

● Communicate with your providers to make sure they know what’s happening with your health care, and to coordinate your service delivery.

Is it true that the state will assist in transportation to help us get to and from medical appointments?

Yes! Alabama Medicaid Non-Emergency Transportation can be reached at Medicaid’s toll-free number, 1-800-362-1504, press option “4″.

Ongoing Waiver Management

- Monthly AAA home visits; quarterly for Personal Choices

- Changes can be made any time (not limited to annual reviews)

- Appeals must be requested in writing

What Else You Need to Know

Now that supports and services are set up, what’s next?

Case managers from the AAA will come to your home monthly to discuss your needs. Personal Choices case managers will come to your home quarterly to discuss the services being provided through self direction. A yearly assessment will be completed followed by a Person Centered Planning meeting to redetermine needs and discuss supports and services to meet the individual’s goals. At any time during the year when needs change, an assessment can be completed and the PCP can be updated to reflect the changes in need.

How do I file an appeal?

Most importantly, request all denials in writing. This applies to requests for additional hours, services, and changes to the person centered plan. Without a written denial, you may be unable to file an appeal. Verbal denials by your case manager at monthly visits are not official denials and strip you of your appeal rights.

Medicaid Waiver Appeals Coordinator

Alabama Department of Senior Services

P.O. Box 301851

Montgomery, AL 36130

1-877-425-2243

Due to disability, the individual or their caregiver requires accommodations for communication. How do we access this reasonable accommodation? All involved in the administration of the E&D Waiver have an obligation to provide communication aids and interpreters at no cost to the individual and caregiver. When contacting your local AAA, request the necessary reasonable accommodation.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.

Common Myths vs. Facts about the E&D Waiver

- Myth: The waitlist is too long. Don’t bother applying.

- Fact: With 15,000 slots state-wide for the E&D waiver, there is no wait list! The only wait should be a 90 waiting period from the time the application is complete to the date eligibility is determined.

- Myth: Your child is too young for this waiver.

- Fact: There is no age restriction for the E&D waiver.

- Myth: You make too much money to qualify.

- Fact: While there are financial restrictions to qualify for the E&D waiver, parent income and assets are not considered when applying for a minor child. Financial eligibility is based on the income/assets of the individual/child applying, not the family.

- Myth: A custodial bank account or 529 Plan will disqualify my child.

- Fact: These types of accounts are typically in the name of the parent/guardian with the child as a beneficiary. Therefore, they do not count as assets of the child.

- Myth: There is a cap on the number of hours of services an individual can receive.

- Fact: While the E&D Waiver is not intended to provide 24/7 care, there is no cap on hours. Determination of hours for supports and services is based on the assessment of need.

- Myth: The pay rate will change if the hours of service changes.

- Fact: When needs change, the determination of need changes, and the budget allocated by ADSS changes. The pay rate on the budget does not change, and the actual pay for employees staffed through Personal Choices is never dictated by ADSS or the AAA. However, an individual or their employer of record can choose to spend the budget in a way that alters the hours staffed from the number of hours used to determine the budget if they choose. This would alter the hourly wage but is entirely the choice of the individual or employer of record, not ADSS or the local AAA.

- Myth: Parents can’t use services in order to go to work.

- Fact: Nothing in the waiver document restricts parent activities or work in order to access supports and services.

- Myth: Parents who work from home can’t get services for their kids.

- Fact: If a case worker tells the parent of a recipient this, ask for them to show you where it states that in the “Medicaid waiver application”. This is a myth, and they will not be able to show recipients and parents this in writing. Services are based on the recipient’s needs. Natural supports cannot be compelled to provide extraordinary services. And, nowhere in federal regulations does it permit for Alabama Medicaid to limit services based on where a parent works, if the parent is a stay-at-home parent, or force the parent to perform extraordinary services.

- Myth: ADSS and the local AAA determine the spending plan for Personal Choices funds.

- Fact: This is a common misconception. ADSS and the local AAA do calculate and approve the “budget” provided for Personal Choices services. However, the Personal Choices “spending plan” is prepared by the individual and employer of record and should be entirely blank when provided to you for the spending plan meeting. The one rule to follow is that 75% of the hours used by ADSS and the AAA to calculate the “budget” must be accounted for in the hours staffed in the “spending plan”. See Q11 for more details and an example.

- Myth: Individuals on this waiver must be homebound.

- Fact: Home and Community Based (HCBS) Settings rule requires each state to ensure that services offered to people with disabilities maximize the control and choice they have in employment, recreation, living arrangements, and transportation.

- Myth: If an individual requires round the clock care, they should be in an institution.

- Fact: While the E&D Waiver is not intended for 24/7 service, there is no cap on the hours of need. Family and friends can choose but are not required to provide “natural supports and services” in order to make up time that is unpaid if they so choose. Many families choose to designate some needed services as paid time through Personal Choices while providing additional care as unpaid natural supports. This choice is made by the individual offering the support, not dictated by ADSS or the local AAA.

- Myth: You can’t get Personal Choices and traditional waiver services.

- Fact: All waiver services are available to those who are eligible, and individuals can utilize both Personal Choices and traditional waiver services.

- Myth: If the caregiver is also the worker under Personal Choices, skilled respite is not an appropriate service

- Fact: Caregivers also need a break, and respite is available for that reason. Skilled and unskilled respite can be provided to an individual to use when their caregiver who works through Personal Choices needs respite.

- Myth: Case managers can deny supports and services, including a request for increased hours or additional supplies, verbally during a monthly check in.

- Fact: Denials of all types must be put in writing with documentation of how to appeal any decision.

- Myth: Changes can’t be made between yearly reassessments.

- Fact: Changes in a person centered plan and changes based on a change in need can be made at any time. Denials of these requests must be made in writing to the individuals.

- Myth: Changes can’t be made upon hospital discharge.

- Fact: When needs change, it is the responsibility of the hospital and the waiver program to collaborate to make sure appropriate supports and services are in place once the individual is discharged. When there is a change in need, the person centered plan should change to reflect that change in need, and a redetermination as well as approval of additions/deletions to the budget should be considered expeditiously by the AAA and ADSS.

- Myth: Supports and services can’t be added to a PCP if there are no available providers.

- Fact: Supports and services are to be added to the PCP based on the need of the individual, not the constraints of the state or accessibility of providers. It is the responsibility of ADSS and the local AAAs to staff those supports and services based on the needs of the individual, not dictate an individual’s needs based on staffing shortages.

- Myth: Individuals can only get the supplies on a pre-approved list and have no choice of providers.

- Fact: The waiver document does not distinguish that waiver funds can only be used for specific items. Needed supplies should be included on the PCP document, and approval should be based on needs, not dictated based on lack of vendors or lack of stock. Note: they will not approve or cover vitamins. Prescribing doctors have tried without success to get these covered for waiver recipients.

- Myth: Support and services for stay at/work from home parents are less than those for families with parents working outside the home.

- Fact: Support and services are based on the needs of the individual without consideration of the parent’s work location. Additionally, parents dictate the number of hours they provide natural support and services. ADSS and AAA should not assume or demand a specific amount of natural support be provided based on working location.

- Myth: A child must be on SSI to be eligible for the E&D waiver.

- Fact: This is untrue. While SSI for minors is based on family income, waiver eligibility is based on the child’s assets and income, not that of the parents.

For assistance on better understanding Medicaid Waivers in Alabama, please reach out to Disability Advocacy Solutions.